Home » Individuals » Types Of Trusts

Trusts are a bit like Liquorice Allsorts – they come in many different shapes and sizes.

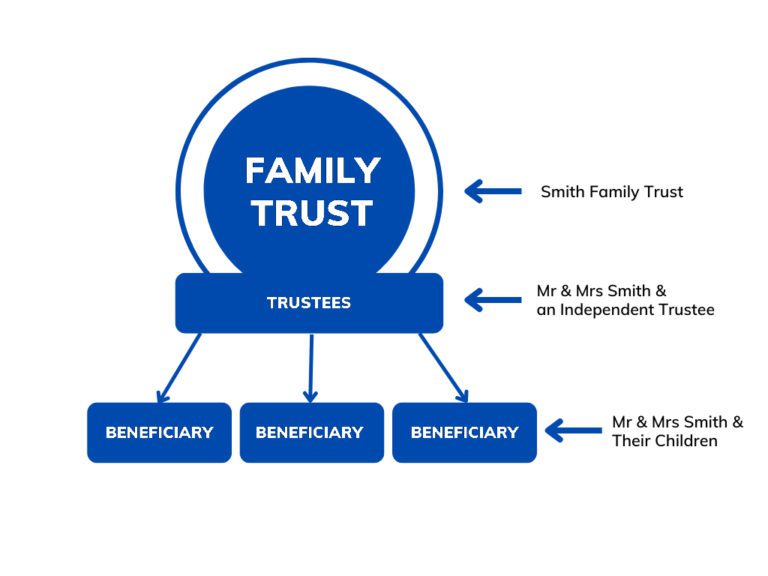

We, however, work only with clients who need assistance in establishing, managing, and administering their Family Trust, Business Trust, and Inheritance Trust. By working with these types of trusts we find we are best placed to satisfy our clients’ needs.

The family trusts our clients establish hold passive assets such as their homes, baches, savings and life insurance policies. They choose for their assets to be held in trusts as opposed to owning them personally because by doing so the assets receive the benefit of protection against creditors.

Ultimately by holding assets in a family trust, wealth is preserved and protected for an individual and their family, for today and for the future. In a way, a family trust is the cornerstone of a person’s financial life.

If you think a family trust could be beneficial to you, or you wish to talk with us about an existing family trust, contact us today.

We’ve been in the business of trusts for over 37 years and have the knowledge and skills required to establish, manage, and administer trusts.

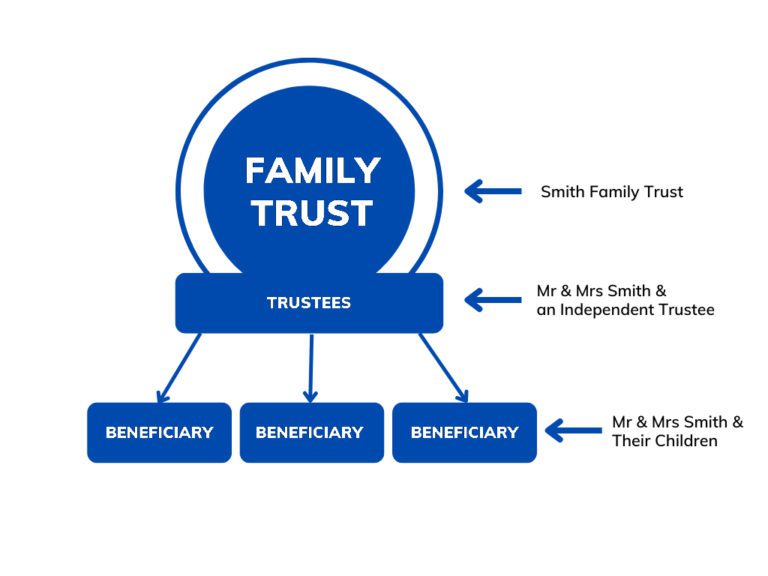

Many single people use family trusts for a myriad of reasons.

These can include the need to create a separation between personal and business assets for asset protection purposes. Or an individual may wish to retain sole ownership of assets they bring to a new relationship from potential relationship claims.

It may even be to keep separate and safe an inheritance a person has received so they can pass that inheritance down to their own children through their own bloodline.

This is especially so with blended families. In such cases, two family trusts may be used to provide for both the separation of assets to each relationship partner and to the co-ownership of specific assets between the relationship partners.

This arrangement of trusts is very prevalent where the interests of children from prior relationships need to be provided for and where individuals have built up wealth prior to meeting their new relationship partner.

Structuring trusts in the above manner can permit the assets a person brings to a relationship to be protected if the new relationship fails. At the same time, it can enable individuals in a relationship to acquire assets through their trusts either in equal or disproportionate shares.

Finally, this composition of trusts can be useful for estate planning purposes enabling assets to be passed to an individual’s children and direct bloodline.

In New Zealand, businesspeople often structure their business affairs using a trust. They may trade in a company and hold the company shares personally.

Alternatively, they may choose to have the shares held by a business trust. A business owner may even elect to have the trust conduct the business as opposed to involving a company in their affairs.

If you would like to chat over your structuring needs, including the potential use of a business trust, contact us.

We work with your accountant and lawyer when considering the use of a business trust.

Business owners frequently find their business trust provides them with the following benefits:

Frequently, people will use a family trust and a business trust in tandem. This is the gold standard of structuring.

At its core, it can permit asset protection, estate planning and tax minimisation goals to be achieved. This combination of trusts can be extremely effective if correctly established and administered properly.

The election of a business structure, including the use of a business trust, will be determined by the specific needs and objectives of the business owner.

Because the choice of directorship and shareholding in a business structure is vital, it’s imperative an adviser is well-versed in structuring, law, accounting, and tax, and is consulted by a proprietor before creating and implementing the business structure.

This is the primary reason we work with a client’s accountant and lawyer when considering the use of a business trust in a client’s affairs.

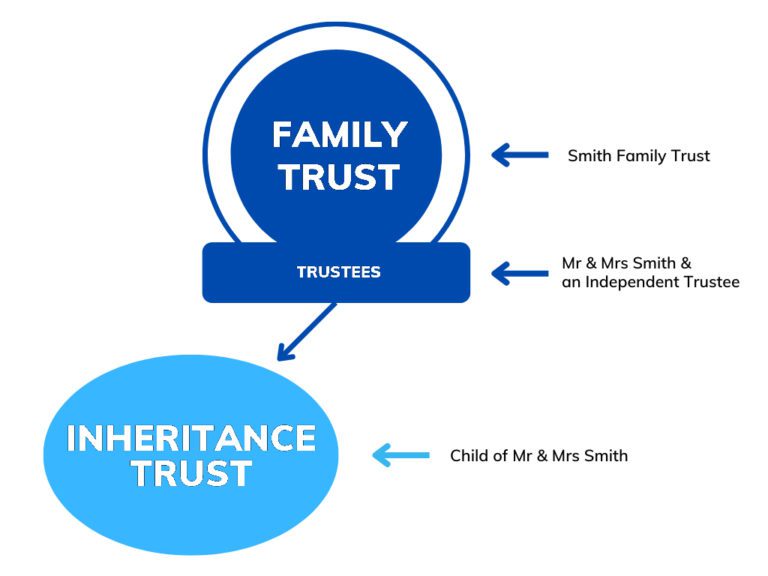

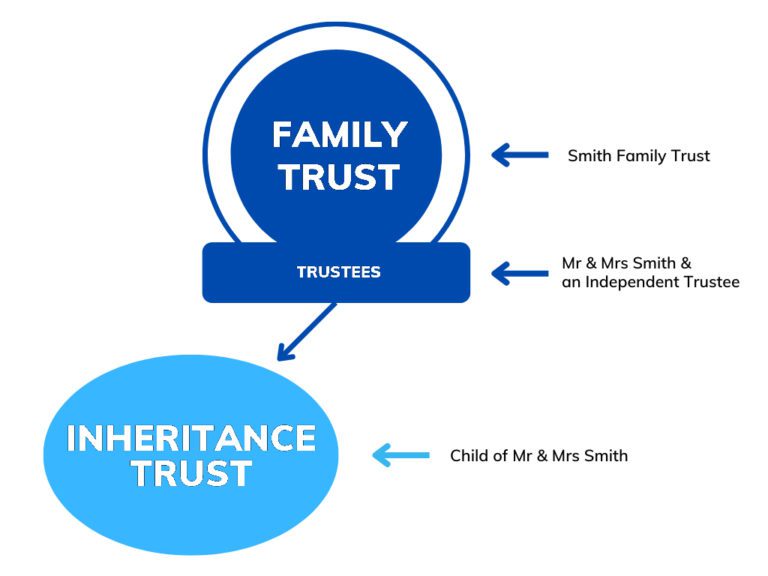

In recent years, inheritance trusts have gained momentum in New Zealand. The growing popularity of these trusts is due to the fact they enable the smooth transition of wealth. Parents especially favour them as they permit the transfer of funds and other assets to their children.

People often think inheritance trusts are used only to pass on wealth when they die. This is a fallacy. In fact, many parents and other generous family members, use inheritance trusts to pass what would be future inheritances to their children and loved family members during their lifetimes. This makes perfect sense as a child recipient will often benefit to a greater degree if they receive an inheritance during their early to middle years than waiting until a parent or much-loved aunt has died.

If you are considering passing wealth to your children and family members, either during your lifetime or upon your death, chat to us about how an inheritance trust could play an integral part in that transfer of assets.

In many instances, the person transferring the wealth will hold that wealth within their own trust. They may wish to transfer wealth during their lifetime to enable their recipient to achieve a particular purpose. For example, a partner may wish to provide funds from their own family trust to their child to enable that child to purchase a home. Assuming bank lending is involved somewhere in this equation, special care must be taken to protect the parent and the assets they hold in their family trust. At the same time, the funds advanced to their child must be protected from any risk that child faces. In such a circumstance, the use of an inheritance trust could be extremely beneficial.

Trusts have been around for hundreds of years, serving as both asset-holding and business-conducting vessels. Their longevity is due to the characteristic of flexibility they possess. They’ve accommodated changes society has demanded, satisfying the varying and growing needs individuals and businesses have.

As trusts’ popularity has grown, so has government, legislative and judiciary involvement. This has been reflected in the Trusts Act 2019 recently being introduced onto New Zealand statute books and to the changes made to the Income Tax Act 2004 and the Tax Administration Act 1994.

Despite legislation, trusts are popular vehicles to help individuals protect their assets, manage their estates, conduct their businesses through, and minimise (legally) their tax liabilities.

To ensure a trust meets a client’s objectives, consultation with qualified advisers in their respective fields is essential. We believe we are one of those advisers. We’ve been in the business of trusts for over 37 years and have the knowledge and skills required to establish, manage, and administer Trusts.

If you want to discuss how a trust could benefit you, or if you are in need of an independent trustee or simply need someone to help you manage and administer your trust, call us. We welcome the opportunity to chat and assist you.

Trust Management + Administration

Trust Management + Administration

COPYRIGHT 2023, ALL RIGHTS RESERVED